ISO 20022 — Front-to-back-to-front

ISO 20022 — Front-to-back-to-front

ISO 20022 — Front-to-back-to-front

April 12, 2024

For decades, the banking sector has been divided into two distinct realms: the glamorous front office, where savvy relationship managers woo clients and close deals, and the enigmatic back office, a complex labyrinth of data processing and business operations aimed at running the bank efficiently and with minimal risk. Traditionally, information flowed in one direction — the front office requested, and the back office delivered.

The traditional division between the front and back offices fosters specialization. To put it simply, front office staff excel in building relationships and generating business, while back office experts focus on business processes, data processing, risk management, and regulatory compliance. This specialization enhances efficiency and accuracy within their respective domains.

However, this separation also results in data silos. Deprived of a holistic view of their clients, front office personnel may struggle to comprehend client behaviors and risk profiles, impairing their ability to offer personalized services and make informed decisions. Additionally, reliance on back office data retrieval can lead to delays, frustrating internal stakeholders or clients who expect prompt responses and seamless transactions, not to speak about the huge amount of unused cash resources ineffectively blocked for settlements.

The key to fully harnessing the potential of both teams might well lie in data, the right data.

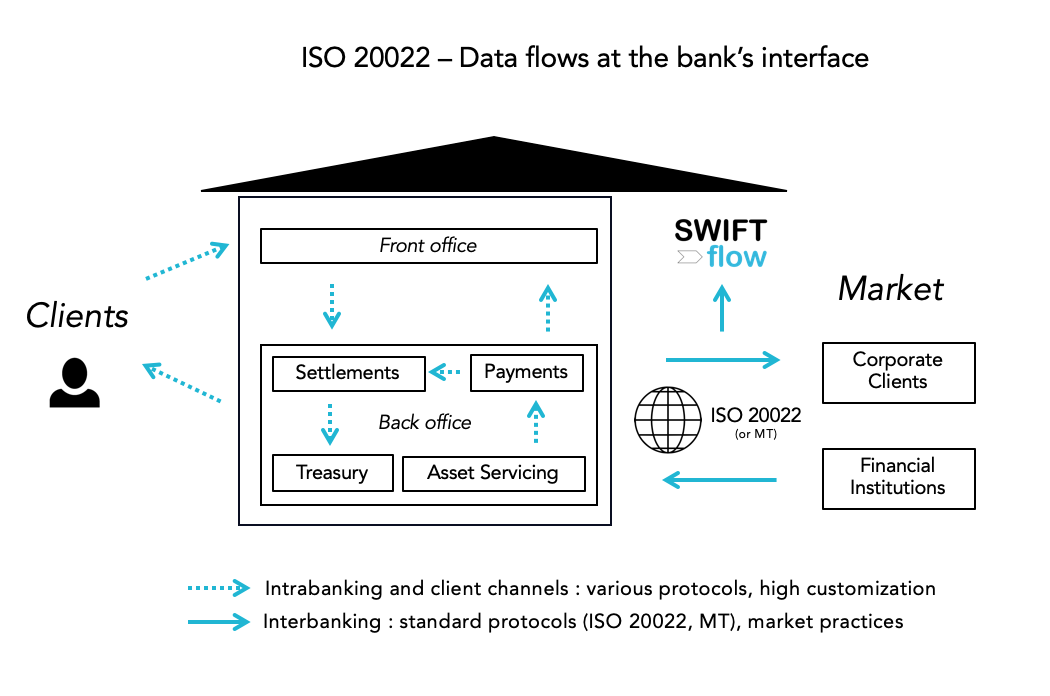

Initiatives like ISO 20022, which promotes a standardized data format for all financial transactions, could bridge these two worlds. By facilitating seamless and self-explaining data exchange between divisions, it equips the front office with broader, deeper and faster insights, straight from the data source. This comprehensive visibility into client data enables more personalized service, quicker decision-making, and, ultimately, an enhanced client experience. It also streamlines delivery and communication, allowing for more precise inquiries and requests to back-office colleagues.

Ultimately, data becomes the common language that blurs the line between front and back office, fostering collaboration and enabling both sides to work together for the success of the bank and its clients.

The prerequisite ? Awareness.

The following narrative, illustrated through the experiences of data scientists Fia and Ben at Ascent Bank, highlights the distinct worlds of the front and back office — their challenges, rewards, and how a unified data asset can unlock new opportunities for both.

Enjoy the story.

Front office: The world of Fia

Fia, a Data Scientist at Ascent Bank’s front office Un:Data Lab, thrives in a dynamic environment of innovation, far from the stereotypical number-crunching in a stuffy suit. Despite tight budgets, Fia’s tech-savvy leadership recognizes the value she brings. They support her innovative proposals, securing funding for custom IT solutions that, while not textbook perfect, deliver results quickly. Her toolkit includes a powerful array of Python, GenAI-based assistants, machine learning libraries, and visually striking tools for data visualization, complemented by her storytelling prowess and keen ability to spot new opportunities.

Fia’s role centers around unlocking customer insights. She analyzes vast datasets — covering transactions, demographics, and client behavior — to identify patterns and guide relationship managers and product developers on optimal strategies.

Her focus is threefold:

- Customer segmentation & targeting: Fia uses data to group customers with similar characteristics, enabling the bank to tailor marketing campaigns and product offerings with precision.

- Credit risk assessment: By examining financial data, such as credit bureau reports and customer behavior, Fia plays a critical role in helping the bank assess the risk of loan defaults.

- ESG product development: At the forefront of a burgeoning trend, Fia develops data-driven financial products that incorporate Environmental, Social, and Governance (ESG) factors alongside traditional financial metrics. She also focuses on detecting and mitigating risks of greenwashing.

Fia’s innovative approaches and advanced tools are pivotal in steering Ascent Bank’s strategy, especially in sustainable finance. However, her effectiveness is sometimes curtailed by limitations in data accessibility from specialized front office systems. While her work earns accolades, aligning the expectations of diverse stakeholders with technological possibilities and ensuring her initiatives are supported by quality data and robust platforms remains challenging. This constant struggle to bridge the data gap limits the potential impact of her efforts.

At a recent data geek meetup, Fia spotted a guy deeply engrossed in his laptop. She recognizes another Data Scientist..

“Hey, I’ve heard some cool stuff about your tech team. I’m Fia, from the Un:Data Lab. We’re developing ESG products, but accessing data is a real pain. Any advice?”

“Hi, nice to meet you. I’m Ben. Mmm… Good question!”

Back office: The world of Ben

Ben, a Data Scientist in Operations, Compliance & Technology at Ascent Bank, doesn’t quite fit the mold of the glamorous data wizards described earlier. His realm involves building, deploying and integrating top-notch machine learning big data solutions within legacy-laden IT and data environments. This challenging setting is compounded by limited availability and budgets from risk-averse business lines, focused on maintaining systems around the clock, much like hospitals. They wish to innovate, but they have little time for it.

Bringing cutting-edge data analytics approaches, tools and platforms, into this complex setting is no walk in the park. Yet, it proves to be immensely rewarding. While constantly learning about a wide spectrum of technologies, Ben discovers that the entire stack of the bank, accumulated over decades, is akin to the layers of ancient Rome, revealing the life cycles of each technological wave and what ultimately remains effective long after the hype has dissipated.

Also, Ben handles all the crucial behind-the-scenes information for the bank — transactions, market data while always handling them with most demanding compliance and security constraints. He isn’t concerned with what customers are purchasing; his focus is on the operational aspects:

- Process optimization: Ben finds satisfaction in enhancing efficiency and reducing costs through data-driven improvements.

- Risk mitigation and compliance: His work is vital for preventing financial crimes, helping the bank navigate the complexities of regulatory mandates.

- Technology platforms: Ben actively influences strategic choices in global technology and IT departments, balancing the urgency to adopt new technologies with the necessity of building reliable long-term systems.

Ben thrives on streamlining mission-critical processes, safeguarding the bank from financial crime, and identifying risks — all crucial for the bank’s smooth operation and success. However, the limited resources and a conservative culture hinder his ability to fully utilize his skills and contribute effectively. Sharing data with revenue generating teams would allow Ben’s expertise to shine, ultimately leading to a more innovative, efficient, secure, and a data-driven bank.

Fia and Ben’s first meeting

“ESG, you say?” Ben interjected, his curiosity piqued.

Fia launched into a passionate explanation. “We’re looking to develop new financial products that consider environmental and social impacts alongside traditional financial metrics,” she explained.

Ben listened intently, his initial confusion transforming into genuine interest. Although ESG specifics were new to him, the underlying concept resonated.

“I’m not an ESG expert, but the data you need might actually be buried in our back-office systems. It could take some digging, but there’s potentially a goldmine there — transaction records with supplier locations, energy usage bills from facilities … you name it.”

A spark of excitement lit up Fia’s face. “A goldmine, huh? That’s exactly what we need ! Listen, I know ESG might be new territory for you, but your data expertise is precisely what I’m missing. Maybe we can team up and see what we can uncover together?”

Ben chuckled, the pragmatist in him intrigued by the challenge. “Sounds like a challenge, Fia. But hey, who knows what kind of groundbreaking sustainable finance products we might cook up with some good transactional data, right?”

Their excitement was palpable.

“Alright, let’s see what we can unearth,” Ben said, metaphorically rolling up his sleeves. “But first, we need a plan. We’re talking about sifting through mountains of data, potentially spread across different systems and formats.”

Fia nodded, her optimism tempered by a dose of reality. “Exactly. I can pull customer information and some basic transaction details, but for the deeper ESG stuff, we’ll need to dive into your territory.”

Ben sighed. “My territory, as you call it, is a labyrinth of legacy systems, multiple regions and markets, and data inconsistencies. Just identifying the relevant data points will be a challenge.”

They spent the next hour brainstorming a battle plan. At the top of their list:

- Data cataloging: They aimed to list all potentially relevant data sets across the bank, including both Front Office and Back Office systems — a monumental task requiring collaboration with IT and a deep dive into technical documentation.

- Data cleaning: They recognized the need for a robust data cleaning strategy to ensure analysis accuracy, given the heterogeneous data in scope.

- Data integration: Even after cleaning, integrating data from disparate systems would be a hurdle. They considered exploring platforms like data lakes and custom data engineering pipelines to unify the data for analysis.

As their list grew, the initial excitement gave way to a sobering realization: this project wouldn’t be a quick win. However, the potential benefits of uncovering hidden ESG insights were undeniable, despite the daunting logistical challenges.

“Well,” Fia said, determination in her eyes, “it looks like we have our work cut out for us. But hey, the bigger the challenge, the bigger the potential reward, right ? Let’s catch up when we know more.”

Ben grinned. “Right, let’s see..”

Fia and Ben’s follow up call

A few days later, Ben was deep into supporting the migration of the bank’s payment systems from the outdated MT standard to the new ISO 20022 format. Amidst the complexities of data mapping and testing, a sudden realization struck him. He immediately called Fia.

“Fia, you won’t believe this!” he exclaimed. “Remember the data we discussed for your ESG project ? Well, there’s actually an emerging payment standard called ISO 20022 that we’re migrating to. It could be a goldmine for you !”

Fia’s interest was piqued. “ISO 20022 ? Sounds like boring stuff. How could that be relevant to ESG ?”

Ben, recognizing her initial confusion, explained, “Let’s step back. Consider all the transactions flowing through the bank — payments, invoices, transfers. That’s transaction data, the lifeblood of any financial institution. ISO 20022 is a new standard for exchanging this data, like a universal language for financial messages but with far more detail than the old system.”

“The exciting part,” Ben continued with newfound energy, “is the extra detail. It could be a game-changer for your ESG and many other client-oriented projects. ISO 20022 can include information like the purpose of a payment, the goods or services involved, even references to certifications, plus details about the actors involved.”

“Imagine a company paying a supplier for ‘eco-friendly packaging’ or ‘conflict-free minerals.’ Information about a company’s ESG practices could be hiding right there in the messages, waiting to be discovered !”

Fia’s eyes widened. “So, you’re saying this standard could reveal a company’s ESG practices based on their transactions? That’s huge !”

“Exactly !” Ben said, a triumphant grin spreading across his face. “And it gets even better. ISO 20022 is standardized, which means the data is structured and organized consistently, perfect for data analysis. We can build algorithms to sift through massive amounts of these messages and identify ESG signals much faster and more efficiently.”

While Fia was convinced, she had more questions. “But what then, Ben ? How do we use this data ?”

Ben, anticipating her concern, elaborated, “Think about it. If a company uses sustainable packaging materials or sources materials from conflict-free zones, that information could be embedded within the ISO 20022 messages. It would be like decoding a hidden ESG narrative.”

Here’s why ISO 20022 could transform Fia’s ESG project..

Richer Data Fields

Unlike the old MT standard, ISO 20022 uses a more structured and detailed format, allowing for specific information beyond basic transaction details. This is where the ESG magic happens.

- Remittance information: This field can hold details about the purpose of the payment, such as a company paying a supplier which we could proxy to “eco-friendly packaging materials.”

- Invoice details: Purpose codes embedded within the message could reveal details about the goods or services being purchased, such as an invoice for “conflict-free minerals.”

- References: ISO 20022 allows for references to underlying data or documents, potentially linking a payment to a supplier’s sustainability report or certifications.

- Rich address information: This is a game-changer for ESG analysis. ISO 20022 includes detailed address fields for both the sender and receiver of the payment. With this structured address information, we can potentially geolocate all parties involved in a transaction on a giant world map, revealing ESG risks (conflict zones, unsustainable sourcing) and opportunities (companies in regions with strong environmental practices).

Structured and standardized

Unlike the free-flowing text of MT messages, ISO 20022 uses a defined tree-like structure made of semantic-rich tags that describe very granular data elements, making the data much easier to parse and analyze with automated tools. Imagine Fia building algorithms to quickly scan a massive dataset of ISO 20022 messages and identify companies with strong ESG practices based on keywords, regions, patterns, and specific data points.

Supply chain transparency

The beauty of ISO 20022 lies in its ability to track data throughout the financial transaction chain. By analyzing these messages, Fia could potentially track a product’s journey — from sourcing raw materials to reaching the final consumer. This could reveal hidden ESG risks or opportunities within a company’s supply chain.

“The implications are enormous,” Fia realized. “With ISO 20022, we could not only identify companies with strong ESG practices but also track specific products and their impacts throughout the supply chain!”

Their initial focus had been on internal data, but ISO 20022 opened a new avenue for gathering ESG insights directly from the data flowing through the bank’s transactions.

Ben and Fia, once distant colleagues, were now united by a shared goal: harnessing data to create a positive impact.

“Last question Ben : Can you provide a CSV file of an ISO 20022 data extract for a preliminary exploration ?” Fia asked.

“Sure, let me query the database. I have a tool to prepare it for you. Will do today.” Ben replied.

“No, wait a second, there’s better ! I can just share with you a link to our cloud-based database that opens from your browser. Doing it now. Click. Done.” Ben replied.

“Received !” said Fia.

About Us

Pierre Oberholzer is the founder of Alpina Analytics, a Switzerland-based data team dedicated to building the tools necessary to make inter-banking data, including Swift MT and ISO 20022, ready for advanced analytics.

George Serbanut is a Senior Technical Consultant at Alpina Analytics supporting Swiftagent — a conversational interface to navigate and query Swift MT and ISO 20022 data.

Reach out directly to pierre.oberholzer@alpina-analytics.com to discuss your use case or visit Alpina Analytics for more information.